Gold Investment 2025: Top Strategies, Affordable Coins, and Smart Buying Insights

Gold has always been a safe haven in times of economic uncertainty. As 2025 unfolds, investors are once again turning to gold to protect their wealth, hedge against inflation, and diversify their portfolios. But what’s the best way to invest in gold this year? Let’s explore strategies, options, and practical tips to maximize your gold investment in 2025.

1. Why Gold in 2025?

Global markets remain volatile, inflation pressures persist, and geopolitical tensions influence currencies. In such an environment, gold remains a stable store of value.

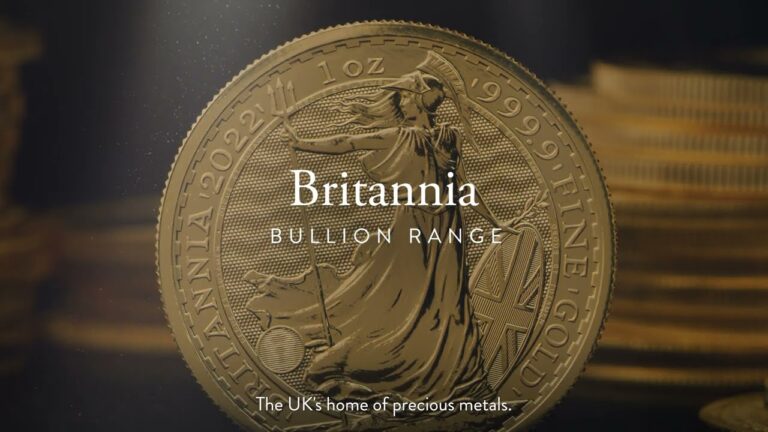

2. Bullion Coins as a Starting Point

Coins like the American Gold Eagle, Canadian Maple Leaf, and South African Krugerrand remain top choices. They are recognized worldwide, making them easy to buy and sell.

3. Fractional Gold for Affordability

Smaller coins such as 1/10 oz Eagles allow investors with modest budgets to gain exposure to gold without large commitments.

4. Gold Bars for Larger Investors

For those seeking to accumulate more gold at lower premiums, bars (ranging from 1 oz to 1 kg) are more cost-effective than coins.

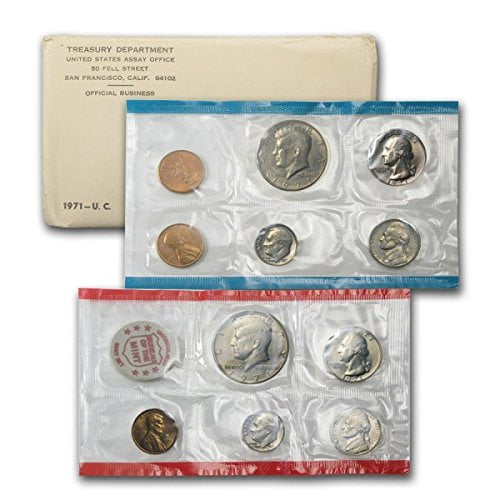

5. Collectible Gold Coins

Numismatic and limited-edition coins offer potential for appreciation beyond gold content. However, they require knowledge and caution.

6. ETFs and Digital Gold

Gold ETFs provide exposure without physical ownership. While convenient, they lack the tangible security of physical gold. Digital gold apps are also gaining popularity for easy, fractional investing.

7. Storing and Securing Gold

Storage options include home safes, bank safety deposit boxes, or private vaults. Security is essential—don’t risk keeping large amounts of gold unprotected.

8. Market Timing and Dollar-Cost Averaging

Timing the market is difficult. Instead, many investors use dollar-cost averaging—buying small amounts regularly regardless of price—to build holdings steadily.

9. Risks to Consider

Gold doesn’t generate interest or dividends. Premiums, storage costs, and market fluctuations must be factored into your strategy.

10. The Smart Investor’s Mindset in 2025

The most important aspect of gold investment this year is a balanced strategy. Don’t put all your money in one type of gold. Diversify between bullion, bars, and possibly ETFs. Gold in 2025 should serve as both a safety net and a growth opportunity within a diversified portfolio.

Conclusion:

Gold remains a wise choice for 2025, but how you invest matters. By blending affordability, security, and diversification, you can turn gold into a reliable anchor in your financial strategy this year.